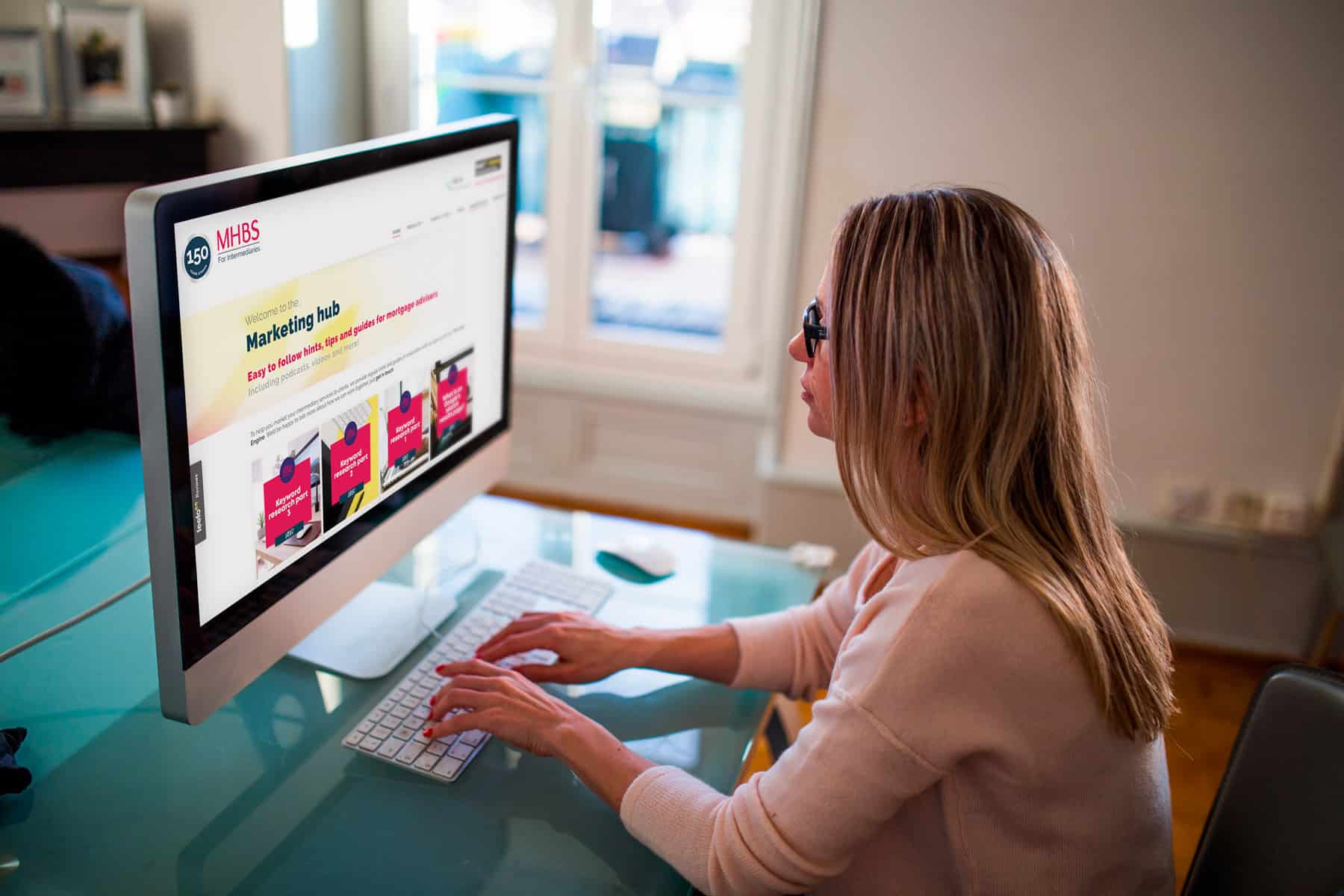

TikTok Mortgage Broker

Glenn Russel is THE TikTok Mortgage Broker with more followers than you can shake a stick at, hear how he did it!

What’s On The Search Results Page?

What is SERP?!…Alex and Tom talk about the recommended do’s and don’ts for getting the best from your Google search results page.

Regular Content For Financial Advice SEO

Why creating regular content is so important and what happens if you don’t.

Adviser & Broker Website Marketing

For several years now we haven’t worked with anyone’s existing website and I want to explain why doing so avoids almost certain failure.

Financial Advisor SEO

They want financial advice, they search for financial advice, and they find you. That’s financial advisor SEO in a nutshell.

Digital Marketing Strategies For Wealth Management

I want to discuss why most digital marketing strategies fail and what I would include instead.

Equity Release Leads

An introduction to generating your own Equity Release leads through your website.

How Important Are Google Reviews For Mortgage Brokers?

There are leads and enquiries up for grabs on Google Maps but you do need to earn the right to be featured and enough reviews to be considered.

How Can You Monitor Lead Quality From Google Ads?

Everyone wants quality leads but what’s the best, fastest and most accurate way to get real time feedback on leads?

Reviews! Which Platform And When To Ask

Google, Facebook, Trustpilot, Feefo, Reviews.io, Vouched For … the list goes on!