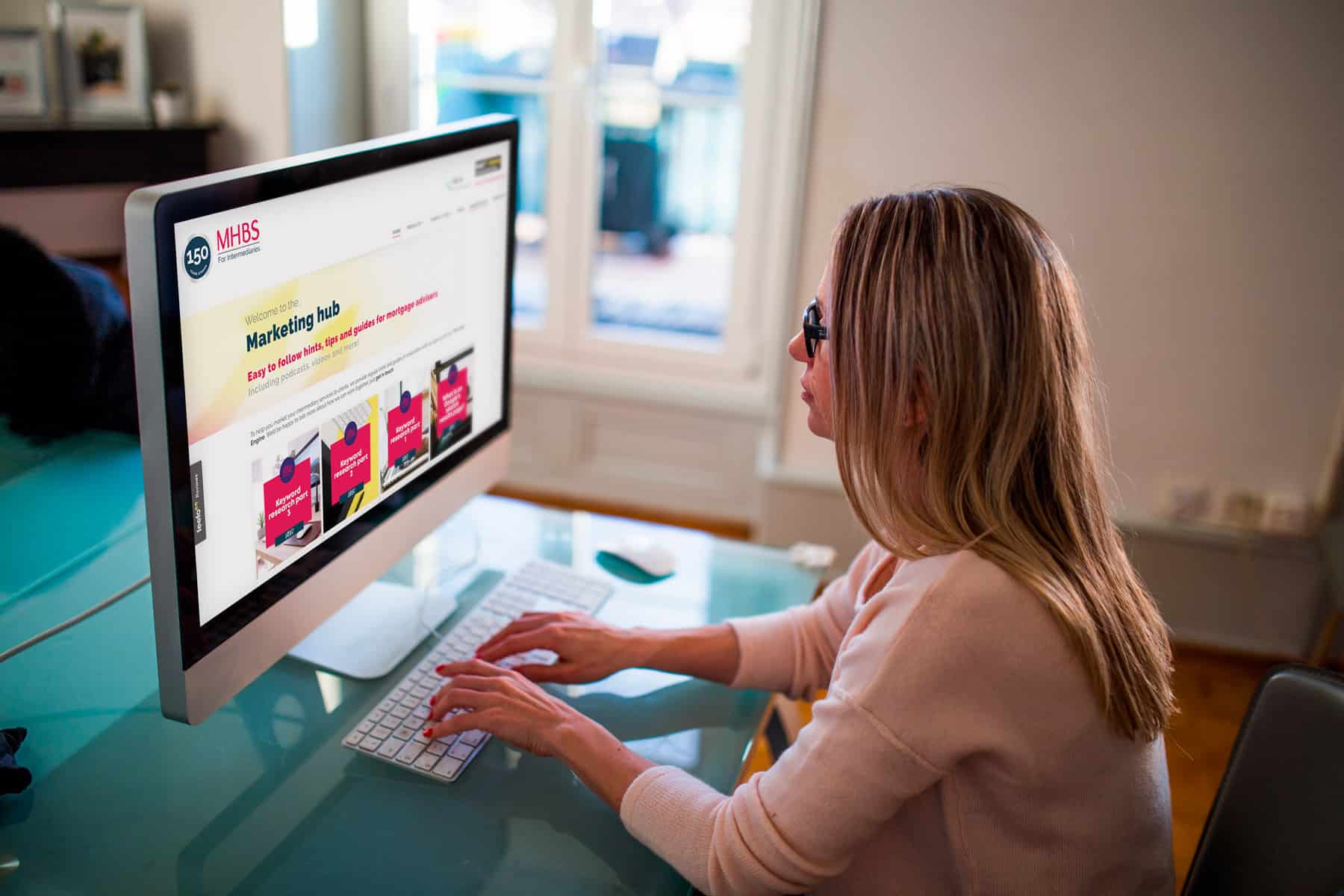

Welcome to The Lead Engine

These are the leads you’re looking for…

1) We drive people looking for financial advice to your website

2) We convert your website into one that will generate more enquiries

3) Your team will speak to more people that want their advice

Want To Find Out More?

The Lead Engine is the go-to partner for financial advice firms

We know that you can attract the best advisers (and keep them) if you can supply them with quality leads.

They’ll be efficient, motivated and generating more revenue if they spend less time leaving voicemails and more time speaking to people who value their advice.

The areas we can help you in are..

How We Help

Getting Free Website Traffic From Google

Mortgage Ads That Work

New research shows Google Ads beat #1 organic results for broker traffic

TikTok Mortgage Broker

Glenn Russel is THE TikTok Mortgage Broker with more followers than you can shake a stick at, hear how he did it!

What’s On The Search Results Page?

What is SERP?!…Alex and Tom talk about the recommended do’s and don’ts for getting the best from your Google search results page.

Faster Leads With Pay Per Click Advertising

‘Talking Ads’ – March 24

This month, the team have selected a variety of different media forms, demonstrating the ways in which you could apply this to your own website and social media platforms.

‘Talking Ads’ – February 24

This month, the team have selected a variety of different media forms, demonstrating the ways in which you could apply this to your own website and social media platforms.

‘Talking Ads’ – January 24

This month, the team have selected a variety of different media forms, demonstrating the ways in which you could apply this to your own website and social media platforms.

Websites

TikTok Mortgage Broker

Glenn Russel is THE TikTok Mortgage Broker with more followers than you can shake a stick at, hear how he did it!

What’s On The Search Results Page?

What is SERP?!…Alex and Tom talk about the recommended do’s and don’ts for getting the best from your Google search results page.

Regular Content For Financial Advice SEO

Why creating regular content is so important and what happens if you don’t.